First, let's take one of those high-quality, non-cyclicals as an example: Johnson & Johnson. Its one of the few AAA-rated corporations left, and pharmas are about as non-cyclical as they get, so it should be a good example of "opportunities" in corporates. Here is the chart of the "spread" on a Johnson & Johnson bond maturing in 2013. The spread here is just the bond's yield less the rate on a corresponding Treasury. Higher spreads mean a greater income differential compared with credit risk-free bonds.

JNJ's spread is well off its high in November, but still much wider than its been in recent years. So yes, in spread terms it looks like a great opportunity.

But is spread the relevant measure for you? If you hedge out interest rate risk, then yes, it is. If you are a relative value portfolio manager, then yes, it is. If you are an investor who must be invested in the bond market, then yes, it is. But for a lot of investors, its a question of yield not yield spread.

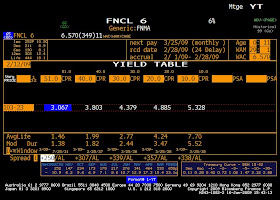

So here is the graph of both yield spread and absolute yield.

Suddenly the great opportunity doesn't seem so great! The fact is that ultra-high quality corporate bonds only look attractive when compared to Treasuries and Agency bonds. For some investors who are living off their portfolio income or are legally bound to the bond market, JNJ is probably a good alternative to ridiculously low Treasury rates. But for those holding on to cash waiting for market conditions to improve, these corporate bonds are a trap.

That's because as global economics improves (thus allowing corporate bond spreads to tighten), it is likely that inflation becomes a major problem. All the stimulus currently being thrown at the economy may be the right policy for now, but it will come with an inflationary cost at some point in the future. When this happens, Treasury rates will rise rapidly. I grant that corporate bond spreads will tighten in such a scenario, but the tightening will probably be overwhelmed by the rise in Treasury rates.

Next, consider the corporate bond market generally. Right now the average yield on a corporate bond, according to Merrill Lynch's index, is 7.64%. That's off the 9%+ that was available in late October, but still, easily higher than has typically been available this decade, either in absolute or spread terms.

Of course, the devil is in the details. Take a look at this histogram of yields within the corporate bond universe, using Merrill Lynch's corporate bond master as the source. It shows the percentage of total bond issues that are currently at a given yield range.

Notice that while the average yield is 7.64%, there is a very wide range. About 1/4 of corporate bonds currently yield 6% or less. Not too exiting. While 1/4 yield 10% or more. Compare this with a similar histogram from the hey-day of corporate bond liquidity, 12/31/2005.

Back then virtually all investment-grade companies carried yields within a narrow range, meaning that it didn't make much difference which corporate bond you owned. Few investment-grade companies were seen as having imminent default risk.

Today, many companies are seen as having rapidly declining credit quality, or at least the risk that credit quality could rapidly decline. Its probable that most of the companies yielding 10% or more will still be around, paying debt service, five years from now. So yes, there are likely some great trades in this group.

But none of these companies are easy trades. Its names like Simon Property Group, International Paper, Alcoa, Macys, US Steel, that are offering the juicy yields. Companies that are right in the teeth of this recession.

So what does the corporate bond market offer? For those who want to just collect income, corporates are a much better choice than either Treasuries or Agency bonds. There are enough solid names to build a diversified portfolio. But this trade is all about the income collection, or the carry. It isn't about making a great trade.

Or its about making the right credit call at the right time. Picking the beaten up name than can recover. But in that case, it isn't an easy trade, its a gutsy call that could wind up with a big capital gain or else a large loss in bankruptcy.

(No positions in any of these companies)