Well, its forecast time. I'm going to do this over the course of four posts, I think. Maybe more. This first post is going to focus on what I see for general economic growth in 2010 assuming basic conditions that exist today persist into the new year. The next post will discuss what I expect the Fed to do in response and why that might cause some problems for risk assets. The third post will look at what happens if the Fed doesn't do what they are supposed to do (a real risk to be sure) and what the consequences will be of that. The fourth post will answer whatever questions I get on the first three.

First I'd like to say that the economy is recovering, but not in quite the same way we've seen in the past. I know its become cliche to talk about a moderate recovery, so here is some nuance you aren't reading every where.

First, the industrial sector is enjoying a strong recovery. The ISM manufacturing survey and Fed's industrial production figures show above-average activity.

Other series confirm the same ideas. Durable goods orders are strong. Capacity utilization has risen from 68.3% to 71.3% in just 5 months. After the 2001 recession, it took over 2 years for capacity utilization to recover 3 percentage points.

It isn't terribly hard to see why industrial production has recovered so much. Look at inventories.

Knowing that demand was as low as it was in 4Q '08 and 1Q '09, the severe drop off in inventories points to virtually no actual production. Thus production has recently increased in a big way mainly as catch-up. For 6-months every one was so scared they did nothing. All that while inventories dwindled. Now in order to sell anything producers need to produce.

This is, of course, one of the textbook reasons why there is typically a boom period after a recession. Inventory rebuilding. That part of the cycle is hardly over. I went back and looked at inventory levels from 1960 to today and divided it by the current dollar PCE index. Basically its an economy-wide inventory to sales ratio.

At first glance this looks like a persistent decline over time. This can be explained by everything you were taught in business school about improvements in inventory management over time.

But take a second look. Basically the ratio is oscillating in a range from 1960-1980. Then there is persistent decline until about 2001, when the ratio gets stuck in the 14-15% range until 2008. Below I've zoomed in to the recent period.

You worry about those fighters! I'll worry about the tower! If firms were to increase inventories from 12.8% of sales to 14.5% of sales, holding PCE constant, it would require a 13.4% increase in inventory levels. That could add considerably to GDP in 2010.

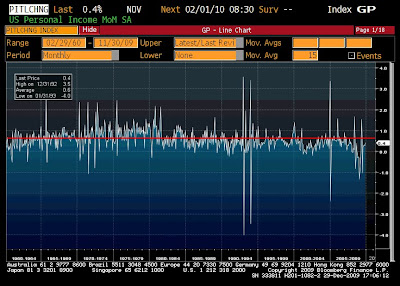

So that's what's booming. You can guess what's mediocre. Consumers. Here's personal income growth. Somewhat below average. And certainly far below average if we took out recessionary periods. Then consumer spending.

Somewhat below average. And certainly far below average if we took out recessionary periods. Then consumer spending.

Same story. Below average and a good bit below average for non-recessionary periods.

What does this point to? A business-lead recovery. Its not impossible. Business spending can and does occur in the absence of strong consumer demand. We know that businesses have spent very little on capital replenishment. Below is non-residential private investment courtesy of the BEA.

You can see that the drop off is much more severe this recession than in 2001 or 1991. In fact, fixed investment as a percentage of GDP (9.5%) is at its lowest point since the early 1960s (although about the same as the 1990-1991 recession.) Since 1960, the average capital spending level as percentage of GDP is 11%. In order to get capital spending up to 11%, businesses would have to increase capex by 16%! Again, this could add considerably to GDP without a serious ramp-up in consumer spending. In fact, I'm modeling that fixed investment adds something like 1.1% to GDP in 2010.

Bottom line: I think GDP grows above 4% on average in 1Q and 2Q 2010, then drops off a bit into the mid 3's for the second half.

I also threw 3.48% on the chart (red line). Can't really say its a top since we broke it several times recently, but notice there's been a lot of work done right around that area. So I really wouldn't be surprised if we need to consolidate around this 3.48% area before we can push much higher in yields. Notice below that we're closing in on an over-sold area as well. (Note I'm using price of the old 10-year for this chart).

I also threw 3.48% on the chart (red line). Can't really say its a top since we broke it several times recently, but notice there's been a lot of work done right around that area. So I really wouldn't be surprised if we need to consolidate around this 3.48% area before we can push much higher in yields. Notice below that we're closing in on an over-sold area as well. (Note I'm using price of the old 10-year for this chart).