Halliburton (HAL)

has had a rocky time in the public relations department ever since the 2010

Gulf of Mexico oil spill but that doesn’t seem to have rankled investors too

much even with the latest revelation that the company destroyed

evidence related to the Deepwater Horizon explosion and subsequent oil

spill.

WHO IS HALLIBURTON

Halliburton is one of the world’s largest providers of

products and services to the energy industry.

The company serves the upstream oil and gas industry from locating

hydrocarbons and managing geological data, to drilling and formation

evaluation, well construction and completion, and optimizing production through

the life of the field.

DESTRUCTION OF

EVIDENCE

Thursday July 25th, the Justice Department announced that Halliburton has agreed to plead

guilty to destruction of critical evidence after

the Gulf of Mexico oil spill in 2010.

The oil services company said it would pay the maximum allowable fine of

$200,000 and will be subject to three years of probation.

The Justice Department said

Halliburton had recommended to BP, the British oil company, before the drilling

that the well include 21 metal centralizing collars to stabilize the cementing.

BP chose to use six instead. During an internal probe after the accident,

Halliburton ordered workers to destroy computer simulations that showed little

difference between using six and 21 collars, the government said, after which

the company continued to say that BP was neglectful to not follow its advice.

While Halliburton’s stock dipped

slightly following Thursday’s announcement, it surged nearly $2.00 in early

trading on Friday. This might signal

investors willingness to overlook the company’s indiscretions in favor of

profits.

2013 QE2

On July 22 Halliburton released their second

quarter 2013 earnings information.

Income from continuing operations

for the second quarter of 2013 was $677 million, or $0.73 per diluted share.

This compares to income from continuing operations for the first quarter of

2013 of $624 million, or $0.67 per diluted share, excluding a $637 million

charge, after-tax, or $0.68 per diluted share, to increase a reserve related to

the Macondo litigation.

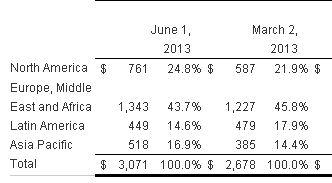

Halliburton's total revenue in the

second quarter of 2013 was a company record of $7.3 billion, compared to $7.0

billion in the first quarter of 2013. Operating income was $1.0 billion in the

second quarter of 2013, compared to operating income of $902 million in the

first quarter of 2013, adjusted for the Macondo charge. For the first quarter

of 2013, reported loss from continuing operations was $13 million, or $0.01 per

diluted share, and reported operating loss was $98 million.

“I am pleased with our second

quarter results, as total company revenue of $7.3 billion was a record quarter

for Halliburton,” commented Dave Lesar, chairman, president and chief executive

officer.

FUTURE OUTLOOK

“For the third quarter, we

anticipate the U.S. land rig count to be flat. We are observing a continuing

trend towards multi-well pad activity among our customer base, which we believe

will result in higher service intensity. Ultimately, we believe this efficiency

trend bodes very well for us, as our scale and expertise allows us to lead the

industry in executing factory-type operations. We also expect North America

margins to continue to expand over the balance of the year. We continue to be optimistic about Halliburton’s

performance for the remainder of 2013, our ability to continue growing our

North America margins, and continued revenue and margin expansion in our

international business. We are relentlessly focused on delivering best-in-class

returns. Our recent quarterly dividend increase, aggressive stock repurchases,

and our $5 billion stock repurchase authorization reflect our growing

confidence in the strength of our business outlook,” concluded Lesar.